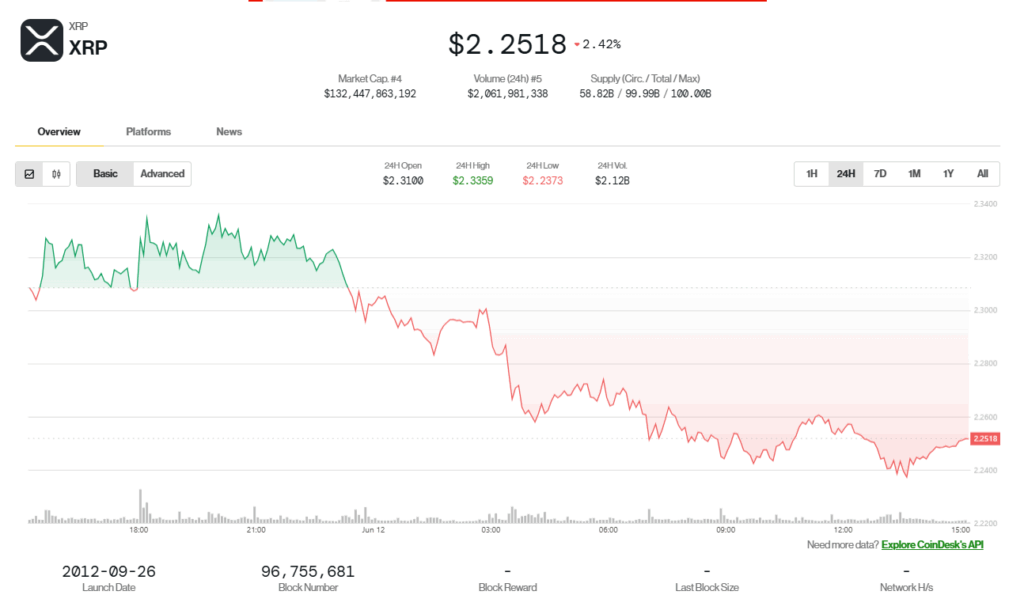

XRP, the world’s sixth-largest cryptocurrency by market cap, is showing signs of exhaustion after a sharp 3.7% intraday drop, signaling weakening bullish momentum and increased bearish pressure.

After touching a session high of $2.288, the token reversed course, eventually closing near $2.260. The move marks XRP’s third consecutive failure to breach the stubborn $2.33 resistance level, a zone that’s fast becoming a psychological ceiling for short-term traders.

“Despite forming a short-term double bottom at $2.250, declining recovery volume points to sustained bearish pressure.”

What’s Weighing on XRP?

The recent dip comes amid a broader cooling in altcoin enthusiasm, following a wave of speculative momentum around a possible spot ETF approval by Franklin Templeton — expected later this month. XRP had seen brief upside during previous weeks on the back of:

-

Ripple’s regulatory wins, including approval of its RLUSD stablecoin in Dubai.

-

Growing confidence in XRP’s enterprise use cases across cross-border payments and real-world asset tokenization.

-

Expanding partnerships in the Middle East and Asia-Pacific, which many analysts believe could serve as a launchpad for the next wave of institutional adoption.

However, technicals now tell a different story: buying power is fading, and traders are becoming more cautious.

Technical Analysis Recap

XRP’s chart has started flashing classic warning signals:

-

Three rejections at the $2.33–$2.34 resistance zone, forming a head-and-shoulders pattern, with the neckline around $2.285.

-

A short-lived double bottom at $2.250 helped trigger a bounce, but recovery volume was notably weak.

-

Peak selling pressure occurred between 01:31–01:33, with more than 7 million XRP tokens traded — indicating possible distribution by larger holders.

-

The rebound began at 01:53, but lower trading volume and weaker follow-through suggest the move lacked conviction.

If $2.25 fails as support, a quick drop to $2.234 is likely, with a potential retest of lower demand zones in the $2.18–$2.20 range if broader sentiment deteriorates.

Market Sentiment: Bulls on Edge, Bears on Alert

This price action has left many bulls rethinking their near-term strategy. Several traders had built long positions in anticipation of a breakout above $2.33, spurred by excitement around ETF news and global expansion.

But now, that setup appears compromised.

According to technical analyst Aditya Mehta:

“XRP’s inability to push past $2.33, even with positive regulatory headlines, signals short-term exhaustion. If $2.25 gives out, we could see a cascade effect with stops being triggered.”

Meanwhile, bears are beginning to re-enter, taking advantage of weakening demand and tighter liquidity at higher levels.

The Macro & Global Context

On the macro side, several factors are also contributing to a cautious tone across the crypto space:

-

The U.S. SEC’s delayed decisions on multiple crypto ETFs have left investors jittery.

-

The Federal Reserve’s recent comments on inflation and rates have triggered a risk-off mood across all markets.

-

In Asia, regulatory uncertainty in South Korea and Japan has put further pressure on trading activity.

Still, XRP remains a focal point in the broader crypto narrative, especially as Ripple continues to build out infrastructure for institutional-grade blockchain payments.

What’s Next for XRP?

All eyes are now on the $2.25 support level, which has historically served as a springboard for price rebounds. If that level breaks, technical targets shift lower, with $2.234 and $2.20 acting as key downside markers.

But if bulls defend $2.25 and volume returns, another retest of $2.33 may not be far off.

Traders Should Watch:

-

$2.25: Immediate support. A breakdown here could trigger a stop-run to $2.234.

-

$2.33: Critical resistance. Until broken decisively, upside remains capped.

-

Volume: Watch for increasing buy volume on recoveries. Without it, rallies will likely fizzle.

-

ETF Decision: Any official comment or movement from Franklin Templeton could shake things up fast.

Community Sentiment: Mixed

Across social media, the XRP community appears divided.

Some are doubling down, citing fundamentals and Ripple’s partnerships, while others are waiting for clearer signals before committing more capital.

“Triple rejection and weak bounce volume? That’s not the XRP we know,” wrote one trader on X (formerly Twitter). “But I’m still stacking — utility is what matters long-term.”

XRP is at a technical crossroads. While its fundamentals remain strong and its long-term roadmap continues to expand across multiple global markets, short-term price action is shaky.

If $2.25 breaks, expect sellers to take control. But if bulls manage to absorb the dip and reignite buying interest, XRP could stage yet another comeback attempt at $2.33 — its most stubborn resistance yet.