The crypto market slipped into a cautious retreat today as Bitcoin (BTC), Ethereum (ETH), XRP, and Dogecoin (DOGE) recorded fresh losses following the release of slightly better-than-expected U.S. inflation data and renewed global economic concerns. Yet, analysts insist this dip may be nothing more than a healthy consolidation in a still-bullish macro trend.

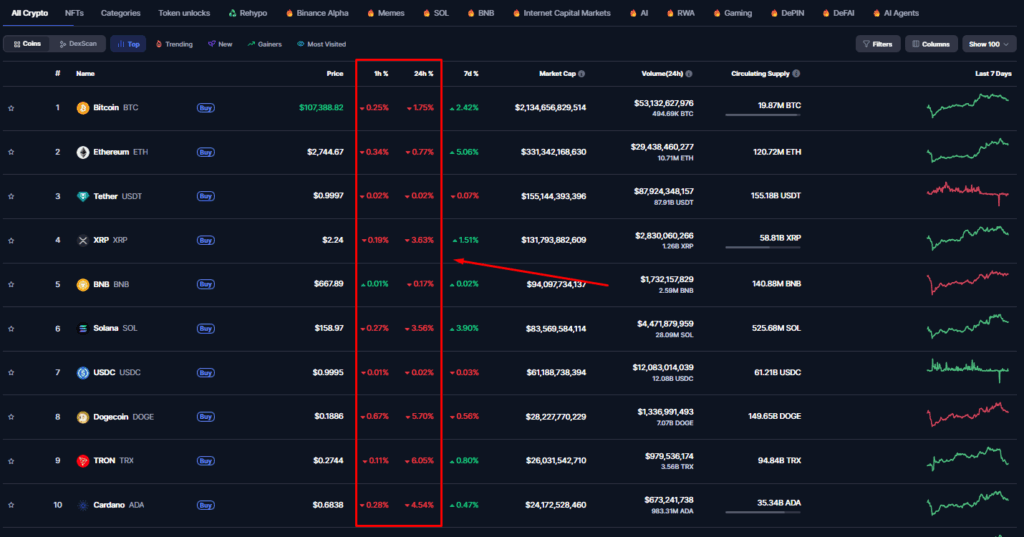

Source: Coinmarketcap

What Happened Today? A Day of Mixed Signals

After initially surging above $110,000 on Wednesday, Bitcoin faced strong resistance and settled at $106,687 by day’s end. As of Thursday, BTC is hovering around $107,634, down roughly 1.4%. Ethereum followed a similar trajectory, testing highs of $2,878 before slipping to $2,720. It’s now stabilizing around $2,750, reflecting a 0.8% dip.

Other major tokens didn’t fare much better. XRP dropped to $2.23 after peaking at $2.3368, while Dogecoin fell 2.5% yesterday and is now sitting at $0.19 — a total 4% slide over two days.

“The latest U.S. CPI data has been published and came in slightly cooler than expected, giving the market some optimism that inflation might be easing,” said Dr. Kirill Kretov of CoinPanel. “However, macroeconomic uncertainty is still high. With the market’s thin liquidity, even moderate players with enough capital could easily move prices against expectations.”

U.S. CPI Report: Relief or Red Flag?

The U.S. Consumer Price Index (CPI) rose 2.4% year-over-year — marginally lower than the forecasted 2.5%. While markets initially welcomed the news, sentiment quickly reversed as investors remained wary of broader macroeconomic headwinds, especially the unresolved U.S.-China trade tensions and mounting federal debt levels.

Simultaneously, the total crypto market cap slid below $3.35 trillion — a crucial technical level — sparking automated sell-offs and triggering over $683.4 million in crypto futures liquidations, with long positions accounting for nearly $618 million of that.

Bitcoin’s Current Technical Landscape

Despite the pullback, analysts suggest Bitcoin’s recent action reflects consolidation, not collapse. BTC’s 24-hour range touched a high of $110,392 and a low of $108,064. Trading volume declined 8.31%, down to $50.9 billion, signaling a lack of aggressive selling.

Here’s a snapshot of the current technical indicators:

-

RSI has cooled to neutral territory, indicating fading bullish momentum.

-

MACD is flattening, with no bearish crossover yet — a typical signal of temporary correction.

-

Stochastic RSI is flashing a short-term sell.

-

Bollinger Bands suggest BTC is testing the midline; a bounce could retarget $111,000, while a breakdown risks $106,000.

-

Volume Oscillator and Choppiness Index show signs of low activity and a sideways range-bound market.

Meanwhile, BTC ETF inflows remain resilient, suggesting long-term confidence remains intact:

-

June 9: $386.2 million

-

June 10: $431.2 million

What’s the Risk? Liquidation Zones in Focus

Heatmap data from the past 24 hours reveals high-leverage short liquidations near $111,194 and long liquidations around $107,530 — both zones BTC is currently trading between. A breach on either side could trigger massive liquidations, introducing volatility. In extreme cases, a fall to $95,867 would wipe out $12.2 billion in longs, while a surge to $122,118 would liquidate $11.35 billion in shorts.

Expert Forecasts for Bitcoin and Ethereum

Despite the recent dip, long-term Bitcoin predictions remain bullish:

-

Bitfinex analysts target $115,000 by early July

-

Tom Lee (Fundstrat) offers an aggressive $150,000–$250,000 target by year-end

-

Changelly estimates BTC hitting $123,000 in the near term

The fundamental thesis? Adoption is still in its infancy. As Bitwise points out, “95% of Bitcoin is mined, but 95% of the world doesn’t yet own Bitcoin.”

Ethereum also shows promise. Technicals suggest ETH broke out of a prolonged consolidation range above $2,730. If momentum continues, the $2,900–$3,000 zone is likely in July. Downside risk remains near $2,280 if macro sentiment worsens.

“There’s a small positive for cryptocurrencies as the CPI data was just below expectations,” noted Paul Howard of Wincent. “We can confidently say we expect a continued sideways movement in digital asset prices for the short term, with expectation prices edge higher over the summer and beyond.”

Altcoins: XRP, DOGE and the Rising Altseason Index

XRP is facing critical pressure ahead of the Ripple v. SEC lawsuit verdict, expected June 16. A favorable outcome could launch XRP toward $0.80+, while negative developments may drag it to $0.45.

Dogecoin remains the weakest technically. Repeated rejections at $0.25 and a persistent downward trendline hint at a potential slide toward $0.15.

However, the Altseason Index has risen to 30, up from 22 yesterday. While still below the 50 threshold, this uptick hints that capital may begin rotating from Bitcoin into altcoins soon.

Conclusion: Not a Crash, But a Pause

This isn’t panic — it’s positioning. The dip appears to be a market reset amid uncertainty and overleveraged longs. Strong ETF inflows, stable technical structure, and key support levels suggest this is a short-term cooldown, not a long-term trend reversal.

For traders and investors, the message is clear: watch the liquidity zones, prepare for volatility, and don’t let the noise drown out the longer-term bullish signals.

Because in crypto, what goes down often rebounds stronger.