The cryptocurrency ETF market is seeing renewed excitement as both Bitcoin and Ethereum-based exchange-traded funds (ETFs) continued to attract large amounts of investor capital. On June 11, Bitcoin and Ether ETFs together brought in more than $400 million, showing strong confidence from institutions and long-term investors.

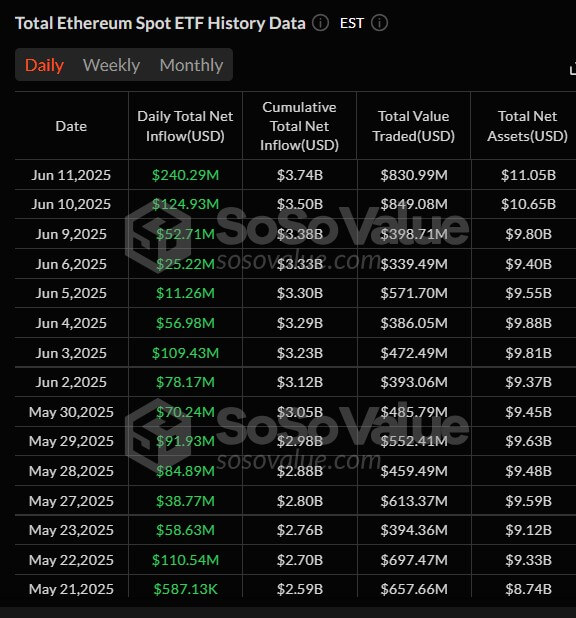

Ethereum ETF Inflows Between May 21 and June 12 (Source: SoSoValue)

Bitcoin ETFs Record Third Day of Positive Inflows

Bitcoin ETFs had a strong day, reporting their third day in a row of net inflows, totaling $164.57 million across four major funds.

- BlackRock’s IBIT led the way with a massive $131.01 million.

- VanEck’s HODL followed with $15.39 million.

- Fidelity’s FBTC added $11.87 million.

- Franklin Templeton’s EZBC chipped in another $6.30 million.

Importantly, no Bitcoin ETF reported outflows, a strong signal of continued belief in Bitcoin’s long-term growth.

Total trading volume for Bitcoin ETFs was $2.41 billion, while total net assets reached $131.85 billion, highlighting the asset’s massive appeal to institutional investors.

Ether ETFs Make History With $240 Million Inflows

While Bitcoin ETFs showed strength, Ether ETFs took center stage by hitting an unprecedented 18th consecutive day of inflows, collecting $240.29 million across five funds. This marks a historic run and growing institutional belief in Ethereum’s long-term potential.

The top contributors were:

- BlackRock’s ETHA — leading by far with $163.64 million.

- Fidelity’s FETH — adding $37.28 million.

- Grayscale’s Ether Mini Trust — bringing in $19.61 million.

- Grayscale’s ETHE — adding $13.30 million.

- Bitwise’s ETHW — rounding out the gains with $6.46 million.

The total trading volume for Ether ETFs reached an impressive $830.98 million, and total net assets now stand at $11.05 billion.

What’s Driving the Momentum?

Several factors are fueling this momentum in crypto ETFs:

- Institutional confidence: Big players are increasingly investing in regulated crypto products like ETFs.

- Ethereum’s upcoming upgrades: Ethereum’s continued improvements are attracting long-term capital.

- Market recovery: After periods of low activity, renewed interest is building up in major crypto assets.

This bullish momentum could be a sign that investors are preparing for a broader crypto rally, especially as regulatory clarity improves and ETF markets mature.

The numbers speak for themselves. With Ethereum ETFs notching 18 days of continuous inflows and Bitcoin funds regaining strength, June is shaping up to be a strong month for digital assets.

If this trend continues, we may be witnessing the early stages of another major wave of institutional adoption — with ETFs acting as the gateway.

Stay tuned. The crypto ETF market may just be getting started.